Great News! IWME Life T100 Is Now Available Up to Age 80

Humania Assurance has announced an important enhancement to its IWME Life T100 product: the eligibility age has been increased to 80. This change broadens the range of clients who can now secure permanent life insurance coverage, particularly those seeking solutions for estate planning, loan protection, or final expenses.

The IWME Life T100 product has always been valued for its simplicity and accessibility. With this recent adjustment, it becomes an even more relevant option for individuals looking for straightforward, reliable coverage later in life.

Key Enhancements

- Eligibility extended to age 80, making the product accessible to a wider audience.

- Coverage options ranging from $50,000 to $100,000, depending on the selected class.

- A simple and digital application process, designed to meet the needs of clients at any stage of life.

Practical Applications

IWME Life T100 offers versatile protection that can contribute to several important financial objectives:

- Mortgage loan protection, helping families maintain stability.

- Funding a child’s education, providing future opportunities for loved ones.

- Inheritance planning, ensuring assets are passed on smoothly and tax-efficiently.

- Coverage of final expenses, relieving families of unexpected financial responsibilities.

With the eligibility age now extended, IWME Life T100 stands out as a more inclusive option for those who may have previously felt limited by age restrictions. This enhancement provides advisors with a flexible, permanent solution to offer—while giving clients the reassurance of a dependable, lifelong benefit.

For clients interested in learning more or exploring whether IWME Life T100 fits their needs, I am always available to provide guidance and personalized illustrations.

Super Visa Insurance: 5 Key Points You Need to Know

Super Visa insurance is a mandatory requirement for parents and grandparents visiting Canada for an extended period. It protects against unexpected medical expenses and ensures that the visitor can receive necessary care without financial risks. Below are the five key aspects to consider when choosing a policy.

1. Minimum Coverage and duration

To apply for a Super Visa, the insurance policy must:

-

provide coverage of no less than $100,000 CAD;

-

be valid for at least 12 months from the date of entry to Canada.

These requirements ensure that the visitor is protected throughout their stay and can access emergency medical care under any circumstances.

2. Coverage for Pre-Existing Conditions: With or Without

One of the most important factors is the health condition of the parent or relative. Many insurance companies offer two options:

-

A policy that covers pre-existing conditions – usually more expensive, but provides protection in case of exacerbations of chronic illnesses such as diabetes, hypertension, or cardiovascular issues.

-

A policy without coverage for pre-existing conditions – a more affordable option, but it may not cover expenses related to previously diagnosed medical conditions.

The choice depends on the traveler’s medical history. If they have chronic conditions, purchasing extended coverage becomes especially important.

3. Emergency Medical Coverage

Super Visa insurance typically includes:

- emergency room services

- hospitalization

- diagnostic testing

- surgeries

- emergency medical transportation

This helps avoid high medical costs in the event of sudden health problems.

4. Refund Options

If the trip gets canceled, the visa is denied, or the stay ends earlier than planned, many insurance providers offer partial or full refunds. This makes purchasing the policy more flexible and less risky.

5. Deductible Options to Reduce the Premium

Many policies allow you to choose a deductible — the amount you pay out of pocket before the insurance coverage takes effect. The higher the deductible, the lower the insurance premium. This can be a useful way to reduce the policy cost.

If you’d like help selecting the best Super Visa insurance plan or understanding the differences between packages, feel free to contact me — I’ll be happy to provide a free consultation and help you choose the ideal policy!

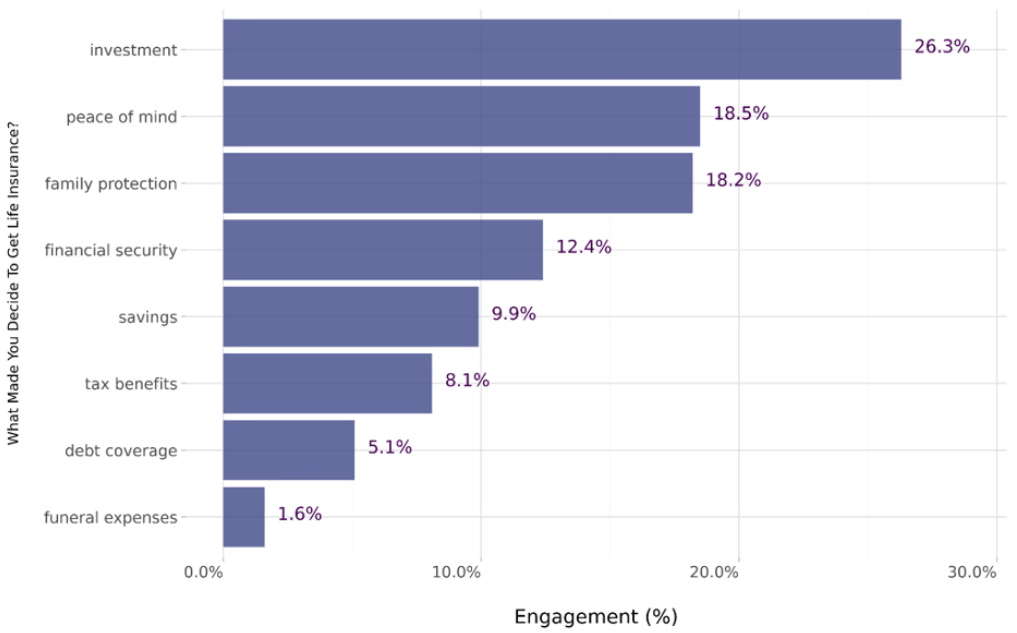

Thinking about Life or Critical Illness Insurance? Here’s What You Should Know!

Whether you’re protecting your family, your income, or your future, choosing the right coverage can make all the difference. Here are a few tips I always share with my clients:

Whether you’re protecting your family, your income, or your future, choosing the right coverage can make all the difference. Here are a few tips I always share with my clients: Ask yourself what you want to protect — your loved ones’ financial security, your mortgage, your business, or your lifestyle. Your “why” determines the type and amount of coverage you need.

• Life insurance pays a lump sum to your loved ones if you pass away.

• Critical illness insurance pays you a lump sum if you’re diagnosed with a serious illness (like cancer, heart attack, or stroke). It helps you focus on recovery — not bills.

Cheaper isn’t always better. Consider how long the coverage lasts, the conditions covered, and any added benefits (like child coverage or return of premium options).

Premiums are lower and approvals are easier when you’re in good health. Waiting can make coverage more expensive — or harder to get.

Major life changes (marriage, kids, new home, new job) often mean your insurance needs change too. A quick review can keep your protection on track.

If you’d like a personalized review or just want to understand your options better, send me a message — no pressure, just good advice

#InsuranceTips #LifeInsurance #CriticalIllness #FinancialPlanning #PeaceOfMind #katsen #alexsandrakatsen #katseninsurance

September is Childhood Cancer Awareness Month: Why Critical Illness Insurance for Children Matters More Than Ever

September is Childhood Cancer Awareness Month: Why Critical Illness Insurance for Children Matters More Than Ever

Each September, the world comes together to recognize Childhood Cancer Awareness Month, shining a light on the thousands of children and families affected by this life-altering diagnosis. While advancements in medicine have greatly improved outcomes, the emotional and financial toll of critical illnesses like cancer remains a harsh reality.

That’s where Child Critical Illness Insurance becomes not just important—but essential.

The Hidden Cost of a DiagnosisWhen a child is diagnosed with a critical illness such as cancer, it’s not just a medical emergency. It’s an emotional and financial shockwave. Parents may have to take extended time off work, travel for treatments, or make major lifestyle adjustments. Government health care plans typically don’t cover everything—especially not the indirect costs like lost income, home modifications, or alternative treatments.

A critical illness insurance policy provides a lump-sum, tax-free payment upon diagnosis of a covered illness, helping families focus on healing—not bills.

Coverage for 37 Life-Altering ConditionsMost people think of cancer as the main concern, but children can be affected by a wide range of serious conditions. A quality child critical illness insurance policy typically covers up to 37 illnesses, including:

- Leukemia and other childhood cancers

- Cerebral palsy

- Cystic fibrosis

- Type 1 diabetes

- Congenital heart defects

- Organ transplants

- Severe burns

- Loss of limbs or sight

...and many more!

This broad coverage means families are protected from many of the most devastating health conditions a child could face.

Return of Premiums: Protection With a Built-in Safety NetWhat happens if your child remains healthy and never needs to make a claim? Many critical illness insurance plans for children offer a Return of Premiums feature. This means that if no claim is made by a certain age, you can get back all or most of the premiums paid. Think of it as a financial safety net that works either way:

- If your child gets sick, you have support.

- If they stay healthy, your money isn’t lost.

Another powerful feature is the policy transfer option. Once your child reaches adulthood, the policy can often be transferred to them, giving them lifelong protection at a locked-in childhood rate—without needing to requalify medically. It’s a gift that not only provides peace of mind during their youth, but also sets them up for financial security well into the future.

A Loving Step You Can Take TodayNo one wants to imagine their child becoming seriously ill—but preparing for the unthinkable is a responsible and compassionate act of parenting. This Childhood Cancer Awareness Month, take the time to explore your options. Critical illness insurance for your child may be one of the most important decisions you make—not just for their health, but for your family’s financial stability and emotional well-being.

Because while you can’t predict the future, you can plan for it.

Understanding Whole Life Insurance in Canada: A Guide to Participating and Non-Participating Policies

Whole life insurance is a cornerstone of financial planning in Canada, offering lifelong coverage and a range of benefits. Whether you're considering it for estate planning, wealth accumulation, or ensuring financial security for your loved ones, understanding the differences between participating and non-participating whole life insurance policies is crucial.

What Is Whole Life Insurance? Whole life insurance provides permanent coverage with three main guarantees:

- Lifetime Protection: Coverage that lasts your entire life, as long as premiums are paid.

- Fixed Premiums: Premiums that remain consistent throughout the policyholder's life.

- Guaranteed Death Benefit: A predetermined amount paid to beneficiaries upon the policyholder's death.

Additionally, many whole life policies include a cash value component. A portion of your premiums contributes to this cash value, which grows over time on a tax-deferred basis. This cash value can be accessed through loans or withdrawals, providing financial flexibility in later years .

Participating Whole Life Insurance

Overview: Participating (or "par") whole life insurance policies allow policyholders to share in the insurer's financial performance through annual dividends. These dividends are not guaranteed but are based on the insurer's actual experience, including investment returns, mortality, and expense factors.

Key Features:

Dividend Options: Policyholders can choose to:

Purchase additional paid-up insurance.

Reduce premiums.

Accumulate dividends with interest.

Receive dividends in cash.

Potential for Higher Returns: While dividends are not guaranteed, they can provide a source of additional funds or coverage.

Considerations:

Higher Premiums: Participating policies typically have higher premiums compared to non-participating policies, reflecting the potential for dividends and additional benefits.Investment Management: The insurer manages the participating account, and policyholders benefit from its performance without direct involvement.

Cost Example:

-

A 30-year-old male might pay approximately $75/month for $100,000 coverage, while a 60-year-old male could pay around $263/month for the same coverage .

Non-Participating Whole Life Insurance

Overview: Non-participating (or "non-par") whole life insurance policies do not offer dividends. They provide a fixed death benefit and guaranteed cash value accumulation, but without the potential for additional earnings through dividends.

Key Features:

Guaranteed Coverage and Premiums: Like participating policies, non-participating policies offer lifetime coverage with fixed premiums.Cash Value Accumulation: The policy builds cash value over time, which can be borrowed against or withdrawn, providing financial flexibility.

Predictable Costs: Without dividends, the cost structure is straightforward, making it easier for policyholders to budget.

Considerations:

No Dividend Potential: Policyholders do not receive dividends, which may result in slower cash value growth compared to participating policies.Simpler Structure: The lack of dividend options makes these policies less complex but also less flexible in terms of potential financial benefits.

Cost Example:

-

A 30-year-old male might pay approximately $100/month for $100,000 coverage, while a 60-year-old male could pay around $217/month for the same coverage .

Why Choose Whole Life Insurance in Canada?

Whole life insurance remains a popular choice among Canadians for several reasons:

Long-Term Financial Security: With lifetime coverage, whole life insurance ensures that beneficiaries receive a death benefit, regardless of when the policyholder passes away.Wealth Accumulation: The cash value component allows policyholders to accumulate funds on a tax-deferred basis, which can be accessed during their lifetime.

Estate Planning: The guaranteed death benefit can be used to cover estate taxes, ensuring that heirs receive the full value of the estate.

Financial Flexibility: Accessing the cash value through loans or withdrawals provides policyholders with financial options in times of need.

Statistical Insights:

- Premium Growth: Canadians paid a total of $27 billion in life insurance premiums in 2022, up from $22.2 billion in 2018, reflecting a 21.6% increase over five years .

- Asset Growth: Life insurance assets in Canada grew from $4,800 billion in 2018 to $5,500 billion in 2022, an increase of 14.6% over five years .

- Coverage Increase: The average life insurance coverage per Canadian household rose from $423,000 in 2018 to $474,000 in 2022, a 12.1% increase .

Choosing between participating and non-participating whole life insurance depends on individual financial goals, risk tolerance, and the desire for potential dividend income. Participating policies offer the possibility of higher returns through dividends but come with higher premiums and less predictability. Non-participating policies provide stable costs and guaranteed benefits but lack the potential for additional earnings.

Whole life insurance serves as a vital tool in long-term financial planning, offering both protection and potential wealth accumulation. It's essential to assess personal financial objectives and consult with a licensed insurance advisor , as myself, to determine the best fit for your needs.

RRSP vs. TFSA – What’s the Difference and Which One Should You Choose?

If you're just starting to explore personal finance in Canada, you've probably already heard of two popular savings options: RRSP and TFSA. Both are great ways to save money, and each has its own advantages. Let’s break down the key differences and help you figure out which one might be right for you.

What is a TFSA (Tax-Free Savings Account)?

A TFSA is a savings account with tax advantages. Any income you earn in a TFSA — whether it’s interest, dividends, or investment growth — is completely tax-free. And the best part: you can withdraw your money at any time, with no taxes or penalties.

Best for people who:

-

Are saving for a vacation, car, or a down payment on a home

-

Want flexible access to their money

-

Want to invest long-term without paying tax on profits

Benefits of a TFSA:

-

No tax on growth or withdrawals

-

Withdraw any time without penalties

-

Doesn’t affect government benefits (OAS, GIS)

Downsides:

-

No immediate tax deduction when you contribute (unlike RRSP)

-

Annual contribution limit (e.g., $7,000 in 2025)

What is an RRSP (Registered Retirement Savings Plan)?

An RRSP is a retirement savings plan that also offers tax advantages, but in a different way. Contributions to an RRSP reduce your taxable income, which means you pay less tax now. However, when you take the money out (usually in retirement), you’ll pay tax on withdrawals.

Best for people who:

-

Want to reduce taxes now

-

Are saving specifically for retirement

-

Earn a higher income and want to defer taxes

Benefits of an RRSP:

-

Reduces your taxes the year you contribute

-

Investment growth is tax-deferred

-

Can be used to buy your first home (through special programs)

Downsides:

-

You’ll pay tax when you withdraw the money

-

Early withdrawals come with tax and penalties (unless through Home Buyers’ Plan or Lifelong Learning Plan)

-

Can affect future government benefits

Key Differences:

| Feature | TFSA | RRSP |

|---|---|---|

| Tax when you contribute | No | Yes – reduces your taxable income |

| Tax when you withdraw | No | Yes – you pay tax on withdrawals |

| Access to money | Anytime, tax-free | Usually at retirement, or with penalties |

| Contribution limit | Same for everyone: $7,000 (2024) | Based on income – up to 18% annually |

| Best for | General savings (short/long term) | Retirement savings |

What Should a Beginner Choose?

-

If you’re young, have modest income, and want flexibility — start with a TFSA. You’ll grow your money tax-free and still have access when you need it.

-

If you have a steady job and higher income, an RRSP can help you save on taxes now and build a retirement fund.

💡 Pro tip: Many Canadians use both accounts — just at different times and for different goals. For example, start with a TFSA for short-term goals, then use an RRSP for retirement savings.

Not Sure Whether to Choose RRSP or TFSA?

Don’t worry — you’re not alone! The best choice depends on:

-

your age and income

-

your current tax situation

-

your goals (vacation, home, retirement, etc.)

-

and even whether you plan to move out of Canada in the future

💬 Reach out to me — and I’ll help you figure out what’s best for your specific situation.

We’ll look at the numbers, clarify your goals, and build a strategy that helps your money grow safely and efficiently.

📞 Message, call, or send a request — and let’s take the first step toward your financial goals today!

Avoiding Costly Mistakes in Health Insurance: A Guide to Protecting Yourself and Your Loved Ones

Avoiding Costly Mistakes in Health Insurance: A Guide to Protecting Yourself and Your Loved Ones

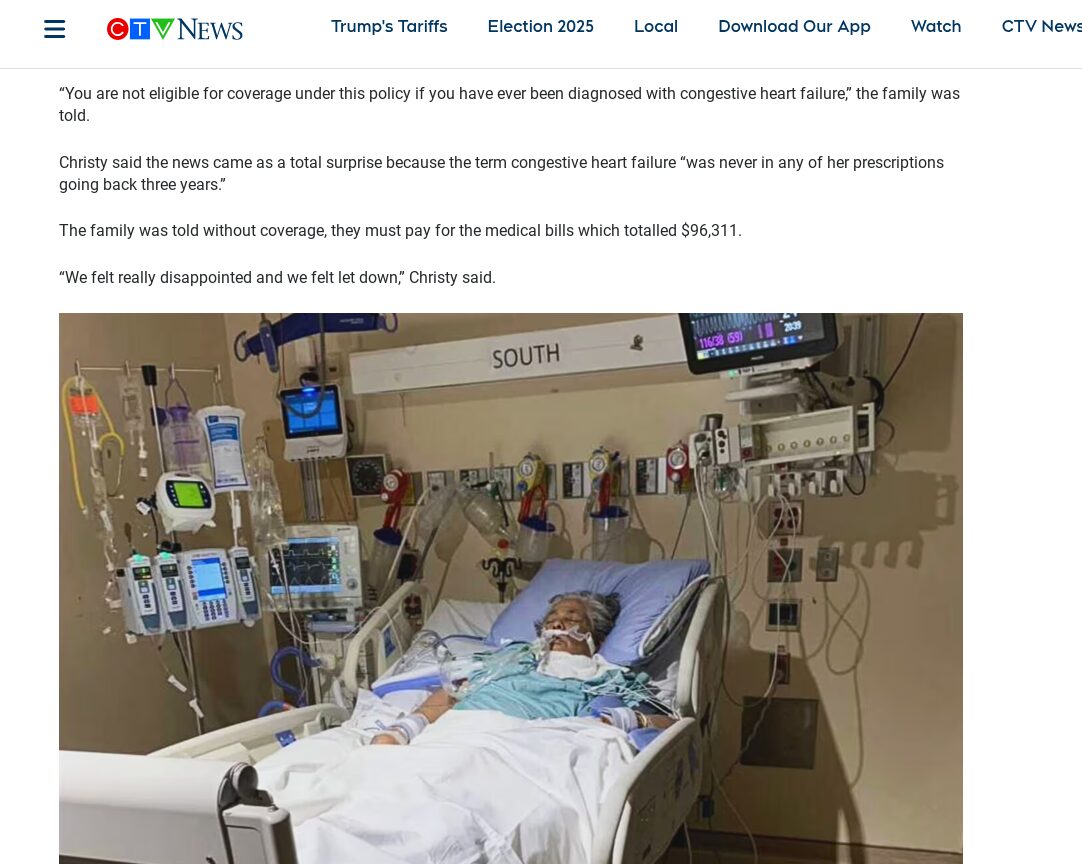

As an insurance professional, I’ve seen firsthand the importance of making informed decisions about your health coverage, and I want to address a situation that’s recently been highlighted in the news. A family from Ontario was hit with a staggering hospital bill of $96,311 after visiting a hospitalised relative in India (the article can be found here:

https://www.ctvnews.ca/toronto/consumer-alert/article/ontario-family-hit-with-96311-hospital-bill-after-visiting-mother-from-india-hospitalized/.

While international medical expenses can be overwhelming, there are critical lessons to be learned here about protecting yourself and your family.

I believe the key to avoiding such financial pitfalls lies in understanding your insurance coverage thoroughly. Here are some tips to ensure that you are properly covered and prepared, especially when traveling abroad or dealing with unexpected medical situations:

1. Never Hide Medical Conditions

When applying for health insurance, full disclosure is essential. If you have any pre-existing conditions or chronic health issues, it’s crucial that you inform your insurance provider. Attempting to hide medical conditions or provide incomplete information might seem like a way to lower premiums, but it can lead to devastating consequences when you need your coverage the most.

In the case of the Ontario family, their situation was complicated by a lack of clarity regarding their coverage and medical history. If they had fully disclosed their medical conditions to their insurer, it’s possible that they would have been able to better navigate the healthcare system in India without facing such astronomical costs.

Insurance companies rely on the information you provide to determine your eligibility for specific coverage. Withholding medical details can invalidate your policy or result in higher out-of-pocket costs when it’s time to claim.

2. Read Your Policy Carefully

It’s easy to skim through the fine print of an insurance policy and assume everything is covered, but that’s a mistake many people make. Take the time to thoroughly read and understand the terms and conditions of your policy. This includes the details on coverage limits, exclusions, and specific provisions for international healthcare.

In the story of the Ontario family, the policy they purchased didn't cover the full cost of treatment abroad, leaving them to cover a large portion of the bill. By fully reviewing their coverage before they traveled, they may have been able to select a more comprehensive plan that would have better supported them in this unexpected situation.

Remember, insurance policies can vary widely, and not all plans offer the same level of international coverage. Whether you’re traveling for business, leisure, or to visit family, it’s vital to know exactly what is included in your policy.

3. Don’t Choose the Cheapest Option

While it may be tempting to choose the cheapest insurance option to save money upfront, this can lead to serious financial headaches down the road. Many low-cost policies offer limited coverage or exclude certain critical areas, especially when it comes to emergency medical care or international health services.

In the case of the Ontario family, opting for a less comprehensive insurance plan may have been a contributing factor to the large bill they faced. When it comes to health insurance, you get what you pay for. Choosing a plan based on price alone without considering the scope of coverage can leave you vulnerable to unexpected expenses.

Instead, work with an advisor to find a policy that balances cost and coverage. A good policy should provide the right level of protection based on your individual needs and the specifics of your travel or healthcare situation.

4. Work with a Knowledgeable Advisor

Navigating the complexities of health insurance, especially when considering international travel or emergency care, can be overwhelming. That’s where a knowledgeable insurance advisor comes in. An experienced professional can help you understand the fine print of your policy, advise you on the best options for your circumstances, and ensure that you’re properly covered for any potential risks.

In cases like the Ontario family’s, having an expert to guide them through the insurance process might have prevented misunderstandings or gaps in coverage. A good advisor can explain your options clearly, help you choose the right level of coverage, and answer any questions you may have, ensuring that you’re not left in a tough situation when you need help the most.

To conclude,Health insurance is a vital safeguard that can provide peace of mind during both routine and emergency situations. However, to ensure it works for you, it’s essential to be transparent about your health, read your policy carefully, and choose the right coverage to suit your needs. Don’t be tempted by the cheapest options – they may end up costing you more in the long run.

Most importantly, work with a knowledgeable insurance advisor who can guide you through the complexities of insurance and help you make informed decisions. With the right preparation and the right advice, you can avoid costly surprises like the Ontario family’s and make sure you’re protected when it matters most.

If you have any questions about your current policy or need advice on finding the right health insurance coverage, feel free to reach out. I'm here to help!

Your Comprehensive Guide to Navigating the Insurance Process

Insurance is a crucial part of financial planning, providing peace of mind and security for you and your loved ones. Whether it’s life, critical illness or disability insurance, understanding the process can help you make informed decisions and secure the best possible coverage. Acquiring an insurance policy involves several key steps, each designed to ensure you receive a product that accurately meets your needs and circumstances. Here’s a comprehensive guide to help you navigate the process of acquiring an insurance policy tailored to your needs.

1. Initial Consultation

First, schedule a meeting with your advisor to discuss which insurance coverage best suits your specific situation. Your advisor will present several options, each with detailed explanations of their advantages and disadvantages. This personalized consultation, including an insurance needs analysis, ensures you make an informed decision. Once you've chosen the right insurance product, you'll begin the application process with the insurance company. Understanding what to expect will help ensure a smooth experience.

2. Application and Submission

In collaboration with your advisor, you'll complete the application form, providing detailed medical and financial information. This level of thoroughness is essential as it directly impacts the underwriting process. Once finalized, your advisor will submit the application to the insurance company on your behalf.

3. Underwriting

After receiving your application, the insurance company assigns an underwriter to assess the risk associated with your case. This step is crucial as it determines the terms of your policy. You may need to provide the following:

Medical Information

Bring all relevant medical information to your medical exam, such as a comprehensive list of illnesses, family medical history, and current medications. Detailed and accurate information can facilitate a smoother underwriting process.

Medical Exam

This exam, conducted based on your age and the insurance amount, typically lasts about 30 minutes. A paramedical professional will ask about your health history, measure your blood pressure, height, weight, and collect a urine sample. For optimal results, fast for 10-12 hours before the exam. This preparation helps provide the most accurate assessment of your health.

Attending Physician Statement

This is a confidential health history record provided by your family physician or medical advisor. It offers an in-depth view of your medical background, which is vital for the underwriting process.

Inspection Report (Financial Underwriting)

A confidential interview conducted by a professional consumer reporting company or credit agency, covering various aspects of your life, including finances, lifestyle, driving history, foreign travel, etc. This comprehensive review helps the underwriter understand your overall risk profile.

4. Policy Issue and Delivery

Once the underwriter completes the assessment, a decision is made regarding your policy. Your advisor will meet with you to review the new policy in detail, ensuring you understand all aspects of the coverage. You will sign a delivery receipt to accept the policy, with 10 days to reconsider. Any due premiums must be paid at this time.

5. Policy Service

Your insurance policy is a living document that may change with life events such as job changes or business purchases. Keep your policy in a safe place and contact your advisor if your circumstances change. Regular reviews with your advisor ensure your policy continues to meet your needs as your life evolves.

Expect the process to take from 4 weeks to 4 months, depending on your situation. Starting a conversation about insurance today can help secure your future, providing the protection you and your loved ones deserve.

If you have questions, please don't hesitate to contact Alexandra Katsen at [email protected]

Dental Insurance: To Get or Not to Get?

Are you self-employed or have a business, but don't have coverage for dental services? Or perhaps you have benefits at work, but every year you find yourself paying extra due to insufficient coverage? This is a familiar situation for many. However, postponing dental care is not only inconvenient but also expensive. Dental care can become a significant expense, especially when an urgent issue arises that requires costly treatment.

Why It's Important to Get Dental Insurance in Advance

Having dental insurance is not just a convenience, but an important precautionary measure. Most people ignore the need to visit the dentist until they begin to experience pain or encounter other issues. However, many dental problems develop gradually, and the sooner you start taking care of your health, the easier and cheaper the treatment will be. Without insurance, this can lead to significant costs.

Standalone Dental Insurance: What Is It and How Does It Work?

You don’t necessarily have to purchase the entire Health and Dental package (benefits), which might include many other options you don't always need. Instead, you can opt for standalone dental coverage — coverage specifically for dental services. This means you will get the necessary coverage for prevention, treatment, and dental surgery without overpaying for additional medical services.

What Does Dental Insurance Cover?

Depending on the plan you choose, insurance can cover:

- Diagnostics

- X-rays

- Preventive care

- Restorative dentistry

- Tartar removal and root planing

- Prosthodontics services for relining or repairing removable or fixed appliances

- Early-stage tooth extractions

Dental insurance allows you to avoid worrying about high costs for treatment and prevention, while also providing regular check-ups that can prevent more serious dental issues from developing.

What to Do if You Already Have Benefits but They're Not Enough?

Many employers offer basic health benefits, including dental, but the coverage can be limited. Often, you’ll find yourself paying extra for treatment, or the coverage may not include the services you need. In this case, standalone dental insurance can be a great solution. It will supplement your existing coverage and provide you with more complete and timely care.

How to Choose the Right Plan?

Before choosing dental insurance, it's important to consider your needs and potential costs. Pay attention to:

- What exactly the plan covers (prevention, treatment, prosthodontics, etc.);

- The monthly premium and potential additional payments for services;

- Limits and exclusions that may be important for your health;

- The availability of partner clinics and dentists your insurance company works with.

Remember that regular preventive check-ups are key to long-term dental health and reducing treatment costs in the future. Dental insurance is an investment in your health that can save you money and nerves in case problems arise with your teeth.

Taking care of your dental health is not a matter of "when it hurts," but a regular necessity. Even if you have basic health benefits, it’s worth considering additional dental coverage that will provide you with full protection and minimize costs. After all, emergency dental treatment can cost several times more than regular insurance. Don’t put off your health until tomorrow — take care of your smile today!

For more information, feel free to contact us! ☎️ Call 204-807-1705 📥 Email [email protected]

7 Common life insurance mistakes to avoid

The decision to purchase life insurance is an important one. It can provide financial support for those who rely on you in the event of your death. However, understanding what is right – or wrong – when it comes to life insurance can be overwhelming. That’s where an advisor can help.

Here are 7 common life insurance mistakes to avoid:

-

Relying solely on group insurance/employer-provided insurance

Having life insurance through your employer’s benefits package is good. But most corporate plans offer only a basic amount and type of life insurance. And it is available only as long as you work at the company. So, if you change jobs, quit, or get laid off, that coverage will end. That’s why it’s important to have your own life insurance policy that you control. You can still have your group insurance; just consider it an additional option. -

Choosing the cheapest life insurance option instead of the best one

There are two main types of life insurance, each with features to meet different needs:

-

Temporary coverage

- Low initial cost

- Fixed payments

- Option to convert to permanent

- Term life insurance

- Lifetime coverage

- Higher cost

- Flexible payments

- Opportunity to build cash value

- Permanent life insurance

Term life insurance is usually cheaper initially than permanent life insurance. However, term life insurance only covers you for a limited time – for example, 10 or 20 years. The cost of term life insurance typically increases when it is renewed. The insurance company pays the benefit if the policyholder dies during the term. In contrast, permanent life insurance will cover you until death, provided you pay your premiums, and while the initial cost may be higher than term life insurance, it will not change.

Term life insurance may be a good option if you have short-term needs. For example, if you have debts like a mortgage and a family or spouse who depend on your income. But if you need lifetime coverage, whole life insurance is likely the better option, if you can afford it. This will help ensure that your estate fees are covered and that you can leave money for your loved ones.

- Underestimating the amount of life insurance you need

It’s important to realistically assess how much coverage you need:

- Funeral expenses

- Legal fees

- Unpaid debts, including mortgage

- How much money your family will need to maintain their standard of living

- Helping your church, university, hospital, or any charitable organization you supported during your lifetime

-

Not telling anyone that you have life insurance

If you don’t tell anyone that you have a life insurance policy, no one will be able to come forward to make the claim. Therefore, it’s important to keep a record of your policy and ensure your family knows where it is. -

Not updating your beneficiaries

It’s important to designate your primary beneficiary and have a contingent beneficiary. It’s also essential to review your beneficiaries with your advisor after major life changes. This could include marriage, divorce, the birth of a child, or the death of a beneficiary. This will ensure that the funds go to the loved ones you want when the time comes. -

Not reviewing your policy and needs

It’s crucial to periodically review your life insurance policy, especially after major life events. Your life insurance needs will change over the course of your policy. All these events play a role in determining how much coverage you need. So, be sure to review your policy with your advisor at least once a year. And if necessary, you may purchase additional coverage. If you need advice, feel free to contact me at 204-807-1705, and we can discuss reviewing your policies. -

Waiting to buy life insurance

Delaying the purchase of life insurance is a fairly common practice. Many people think they need to wait until they get married, have children, or buy a home. But purchasing a policy at a younger age is generally less expensive. You’re also less likely to have health issues that could make insurance expensive or render you ineligible for coverage. So, the sooner you buy life insurance, the better.

If you have any questions or would like to discuss your policy, please contact me at 204-807-1705. I’d be happy to help!

New Year, New Beginnings: The Importance of Critical Illness Insurance in 2024

As the year draws to a close and the excitement of a fresh start fills the air, many people focus on setting new resolutions, planning vacations, and achieving personal milestones. But as we step into 2025, one often-overlooked resolution is to take charge of our health and financial security. One of the most vital, yet commonly neglected, aspects of this is ensuring that you have the right kind of insurance coverage. Among the various types of insurance available, critical illness insurance stands out as one of the most important protections you can have for your well-being and peace of mind.

What is Critical Illness Insurance?

Critical illness insurance is a type of policy that provides a lump sum payment if you are diagnosed with one of a range of serious illnesses. These typically include conditions such as cancer, heart attack, stroke, kidney failure, and other life-altering diseases. The purpose of this insurance is to help you cope with the financial burden that often accompanies such health challenges.

Unlike health insurance, which may only cover medical expenses, critical illness insurance offers a financial safety net for living expenses, treatments not covered by regular health insurance, or adjustments to your lifestyle while you recover. It can be the difference between focusing on getting better and worrying about how to pay bills or take care of your family during a health crisis.

Why Should You Care About Critical Illness Insurance in 2024?

As we enter a new year, it’s a good time to consider how to improve your life — and securing critical illness insurance is an essential step in that direction. Here's why:

1. Increasing Healthcare Costs

Healthcare expenses are rising, with treatments for serious illnesses becoming more expensive every year. Even with a good health insurance plan, you may still face out-of-pocket expenses, such as co-pays, deductibles, or treatments not covered by your plan. Critical illness insurance can cover these additional costs, ensuring you don’t need to drain your savings or rely on credit.

2. Protection Against Financial Ruin

A severe illness can leave you unable to work for an extended period, draining your income and putting your financial stability at risk. Critical illness insurance provides a lump sum that can be used for a variety of purposes — from paying your mortgage to covering daily living costs. This means that while you're focusing on recovery, your financial worries are less likely to compound the situation.

3. Peace of Mind During Tough Times

The emotional and physical toll of facing a serious illness is immense. Critical illness insurance offers peace of mind, knowing that you have a financial cushion to support you during this challenging time. It allows you to focus entirely on your health without the added stress of managing finances.

4. Customization and Flexibility

Critical illness policies are typically customizable, meaning you can choose the level of coverage based on your needs and budget. Whether you want a broader range of illnesses covered or a policy that focuses on the most common conditions, there's a plan for everyone. Additionally, these policies are often more affordable than you might think, especially when you're younger and healthier.

5. Support for Families and Loved Ones

A serious illness not only impacts you but also your family and loved ones. Critical illness insurance can help ease their burden, as it can be used to hire help, make necessary home modifications, or cover lost income. It’s a way to protect your family's well-being, so they don’t have to make difficult decisions when you’re unable to work or care for them yourself.

How to Get Started with Critical Illness Insurance

As you plan your new year’s resolutions, consider adding critical illness insurance to your list. Here are a few steps to help you get started:

-

Evaluate Your Health Risks: Consider your personal and family medical history, your lifestyle, and your health habits. If you're at higher risk for serious illnesses, critical illness insurance may be particularly important.

-

Research Your Options: Different insurers offer different policies, so it’s essential to compare coverage, premiums, and conditions. Look for policies that cover the most common and most severe critical illnesses, like cancer and heart disease.

-

Consult an Insurance Expert: If you're unsure where to start, speaking with an insurance agent or financial advisor can provide valuable insights. They can help you understand the policy details, coverage limits, and exclusions.

Conclusion: A Healthy Financial Future

As we enter 2025, it’s important to remember that a healthy future doesn’t just depend on physical well-being, but also on the security of your finances. By investing in critical illness insurance, you're protecting yourself from the unexpected — whether it’s a sudden diagnosis or a long road to recovery. Health is our most precious asset, but it’s also important to have the financial tools in place to safeguard our well-being and that of our loved ones.

This New Year, make a resolution that goes beyond personal growth and goals. Resolve to protect your health, your finances, and your future by considering the value of critical illness insurance. It’s a decision that could be the difference between a challenging time and one where you can focus solely on recovery without the added stress of financial strain.

How AI Will Affect the Life Insurance Industry?

AI's Impact on the Life Insurance Industry

- Enhanced Underwriting and Risk Assessment

AI is revolutionizing the underwriting process, which traditionally involves manual assessment of a policyholder's health, lifestyle, and other factors. With AI-powered tools, insurers can analyze large sets of data, including medical records, lifestyle habits, and even social media activity, to better understand an applicant’s risk profile.

- Faster Decisions: AI can process and analyze data much faster than human underwriters. This leads to quicker approval or rejection of policies, improving efficiency for insurers and creating a better experience for customers.

- More Accurate Risk Prediction: AI algorithms can predict potential health risks more accurately by analyzing patterns and trends that might go unnoticed by human underwriters, resulting in more precise pricing for policies.

- Personalized Coverage: AI allows for more customized insurance products. Insurers can offer policies tailored to an individual’s unique health status and risk factors, potentially leading to better value for both the customer and the insurer.

- Improved Customer Experience

AI-powered chatbots, virtual assistants, and other tools are enabling life insurance companies to provide round-the-clock customer service. This improves the overall customer experience by offering faster, more responsive service, whether it’s answering policy questions, providing updates, or assisting with claims.

- Chatbots and Virtual Assistants: AI-driven chatbots are available 24/7 to help customers with basic inquiries, guide them through policy options, or explain terms and conditions. This saves time for both the insurance company and the customer.

- Claims Processing: AI can speed up the claims process by automatically assessing damage reports, medical records, and other relevant data. This leads to faster payouts, which is a key driver of customer satisfaction.

- Predictive Analytics: AI allows insurers to predict customer needs more effectively, anticipating when customers might need policy changes, renewals, or additional coverage, creating a more proactive customer experience.

- Fraud Detection and Prevention

Insurance fraud is a significant issue in the life insurance industry, but AI is helping insurers detect fraudulent claims before they are paid out. Using machine learning models, AI systems can analyze patterns of behavior across a vast amount of data and flag suspicious activities.

- Real-Time Fraud Detection: AI can analyze data in real time to identify red flags or inconsistencies in claims, preventing fraudulent claims from being processed.

- Pattern Recognition: AI can detect patterns of fraudulent behavior that human adjusters might miss, reducing the risk of payouts on fraudulent claims.

- Cost Savings: By reducing fraud, AI helps insurers save money, which could potentially lower premiums for policyholders.

- Automated Policy Recommendations and Sales

AI tools can help insurers deliver more personalized policy recommendations to customers, increasing the likelihood of a sale and improving customer satisfaction.

- AI-Powered Advisors: AI systems can analyze a customer’s unique situation—such as their income, health history, and family obligations—and suggest life insurance products that are best suited to their needs.

- Personalized Marketing: AI can also be used to personalize marketing efforts, ensuring that customers are only presented with relevant products based on their specific characteristics. This approach increases conversion rates and boosts overall sales.

- Lead Scoring: AI can help insurance companies prioritize leads by analyzing customer behaviors and determining which individuals are most likely to convert. This can help agents focus their efforts more effectively.

AI is set to revolutionize the life insurance industry, creating new efficiencies, improving customer experiences, and enhancing risk management processes. For insurance agents, AI presents both opportunities and challenges. While the automation of administrative tasks and AI-driven insights can increase productivity and allow agents to focus more on relationship-building, there are concerns about job displacement and the need to adapt to new technologies. The key for insurance agents will be to embrace AI as a tool that can enhance their work, rather than replace it, ensuring they remain valuable partners for their clients in an increasingly tech-driven world.

As AI continues to reshape the life insurance industry, the successful agents will be those who can combine the power of AI with their own expertise and personal touch, offering clients the best of both worlds.

#insurance #katsen #katseninsurance #alexandrakatsen #agent #insuranceagent #katsenalexandra

Understanding the Differences Between Mutual Funds and Segregated Funds in Canada

What Are Mutual Funds?

A mutual fund is a type of investment vehicle where money from many investors is pooled together to invest in a diversified portfolio of assets like stocks, bonds, and other securities. Mutual funds are managed by professional portfolio managers who make decisions on behalf of the investors.

Here’s a closer look at how mutual funds work:

- Pool of Money: Investors purchase units or shares in a mutual fund. Each investor’s money is combined with others to buy a variety of investments, aiming to reduce risk by diversifying the portfolio.

- Managed by Professionals: A professional fund manager decides which assets to buy and sell, based on the fund’s investment strategy.

- Liquidity: Mutual funds are highly liquid, meaning you can generally buy or sell your shares at the daily Net Asset Value (NAV) price, which reflects the value of the underlying assets.

- Fees: Mutual funds charge management fees (MERs), which are deducted from the returns of the fund. Some funds may also charge additional fees for services or trades.

What Are Segregated Funds?

Segregated funds, on the other hand, are similar to mutual funds in that they pool money from multiple investors to invest in a diversified portfolio. However, there are some key differences, particularly when it comes to guarantees and the structure of the investment.

Here’s what sets segregated funds apart:

- Insurance-Backed Investment: Segregated funds are typically offered by insurance companies, and they come with certain guarantees that are not available with mutual funds.

- Guarantees: The key feature of segregated funds is that they often offer a principal guarantee (usually 75% to 100% of the original investment) if held until maturity. This means you may receive back most or all of your initial investment, even if the value of the underlying assets declines. This guarantee generally applies if the fund is held for a specific period (e.g., 10 years).

- Insurance Benefits: Segregated funds also offer unique insurance benefits, such as potential creditor protection (which can be important for business owners or those in high-risk professions) and the ability to name a beneficiary. This can make segregated funds a good option for estate planning.

- Fees: Like mutual funds, segregated funds charge management fees (MERs), but they can be slightly higher due to the additional guarantees and insurance features.

- Liquidity: Segregated funds offer liquidity, but the guarantees may not apply if you withdraw before the maturity date, which can limit access to your money without penalties.

Key Differences Between Mutual Funds and Segregated Funds

| Feature | Mutual Funds | Segregated Funds |

|---|---|---|

| Investment Structure | Pooled investment managed by professionals | Pooled investment with added insurance features |

| Guarantees | No guarantees | Principal guarantee (usually 75-100%) if held until maturity |

| Creditor Protection | No creditor protection | Potential creditor protection, especially for business owners |

| Estate Planning | No special estate benefits | Ability to name a beneficiary and avoid probate |

| Liquidity | High liquidity (can be bought/sold daily at NAV) | Less liquid (guarantees apply if held for a certain period) |

| Fees | Management fees (MERs) | Higher management fees due to insurance features |

| Risk | Investment returns depend on market performance | Lower risk due to the principal guarantee, but not as flexible |

| Tax Treatment | Taxable when profits are realized | Taxable, but may offer some flexibility in estate planning |

Pros and Cons of Mutual Funds

Pros:

- Liquidity: You can easily buy and sell shares, making mutual funds a flexible option.

- Lower Fees: Typically, the fees are lower than segregated funds because there are no insurance guarantees or additional benefits.

- Diversification: Mutual funds allow you to invest in a variety of assets, which helps spread out the risk.

- Professional Management: Fund managers handle the investment decisions, so you don’t need to actively manage your portfolio.

Cons:

- No Guarantees: There is no guarantee of getting back your initial investment if the market drops.

- Higher Risk: Because there are no guarantees, you may experience significant losses, especially in volatile markets.

- No Estate Benefits: Mutual funds don’t have specific benefits related to estate planning or creditor protection.

Pros and Cons of Segregated Funds

Pros:

- Principal Guarantee: Many segregated funds offer a guarantee that you will get back a percentage of your initial investment (e.g., 75%-100%) if you hold it until maturity.

- Creditor Protection: The funds may be protected from creditors, which is beneficial for people in high-risk professions or those running their own business.

- Estate Planning Benefits: Segregated funds allow you to name a beneficiary, and they can bypass probate, which may reduce the time and cost involved in transferring assets upon death.

Cons:

- Higher Fees: Segregated funds generally have higher fees than mutual funds, due to the insurance guarantees and additional benefits.

- Lower Liquidity: You may not be able to access the principal guarantee unless you hold the fund until the maturity date, making them less flexible than mutual funds.

- Complexity: The added insurance features and guarantees can make segregated funds more complicated to understand compared to mutual funds.

Which Is Right for You?

Choosing between mutual funds and segregated funds depends on your individual financial goals, risk tolerance, and need for added benefits such as guarantees or creditor protection. Here's a breakdown to help guide your decision:

-

Choose Mutual Funds if: You’re looking for flexibility, lower fees, and a straightforward investment that you can manage easily. Mutual funds are ideal if you have a long-term investment horizon and are comfortable with market fluctuations.

-

Choose Segregated Funds if: You want the peace of mind of a principal guarantee, are seeking creditor protection, or are planning for estate transfer. Segregated funds are also a good option for business owners or those who need additional financial security.

Both mutual funds and segregated funds offer Canadians valuable investment opportunities, but they come with distinct features that cater to different financial needs. While mutual funds are a popular choice due to their flexibility and lower costs, segregated funds offer added security through guarantees and insurance features, which may appeal to those seeking more protection for their investments. Understanding the key differences between these two options will help you make a more informed decision based on your personal circumstances and financial objectives.

#insurance #katsen #katseninsurance #alexandrakatsen #agent #insuranceagent #katsenalexandra

Why Purchase Travel Insurance When Flying Abroad?

Traveling abroad can be one of the most rewarding experiences, offering the chance to explore new cultures, relax on exotic beaches, and create lasting memories. However, when you venture outside of Canada, unforeseen circumstances such as medical emergencies, flight delays, or lost luggage can disrupt your plans. To safeguard your trip and ensure peace of mind, purchasing travel insurance is a smart and responsible decision for every Canadian traveler.

1. Medical Coverage for Unexpected Health Issues

One of the most significant reasons to purchase travel insurance is to protect yourself from medical expenses. While Canada provides excellent healthcare for its residents, provincial health insurance plans do not cover medical costs abroad. Without travel insurance, Canadians may face hefty medical bills if they become sick or injured while overseas.

For instance, consider the story of Sarah, a Canadian tourist who flew to Mexico for a week-long vacation. On her second day there, Sarah began feeling unwell. Despite taking precautions, she developed severe stomach pains and was quickly hospitalized. It turned out to be a bacterial infection that required multiple days of treatment, including hospitalization and prescription medications. The medical bills exceeded $10,000 USD, an amount Sarah could never have anticipated. Fortunately, Sarah had purchased travel insurance before her trip, which covered her medical expenses in full, sparing her from financial hardship. Without the safety net of insurance, she would have faced significant financial strain and potentially disrupted her entire vacation.

2. Emergency Medical Evacuation

In some cases, if you fall seriously ill or sustain an injury, you may need to be evacuated to a more advanced medical facility, either within the country or back home to Canada. This type of medical evacuation can be extremely costly, often running into tens of thousands of dollars. Travel insurance provides emergency evacuation coverage, ensuring that you are transported safely without bearing the financial burden.

Imagine if Sarah’s condition had been more severe and required her to be flown back to Canada for more intensive care. Without travel insurance, the cost of this evacuation would have been astronomical, likely beyond her means. However, because Sarah was insured, she was able to receive the necessary care and transportation back home without any additional financial stress.

3. Trip Cancellation and Interruption Protection

Travel insurance also protects you in the event that you need to cancel or interrupt your trip. Life is unpredictable, and there may be situations such as illness, family emergencies, or natural disasters that force you to cancel your flight or cut your trip short. Without insurance, you could lose a significant portion of the money spent on flights, hotels, and tours.

For example, if Sarah had fallen ill right before her trip, or if her condition worsened while abroad, her travel insurance policy would have allowed her to cancel her trip or return home early with minimal financial loss. Travel insurance often includes reimbursement for non-refundable costs like flights, hotel bookings, and pre-paid tours, which can help ease the financial burden of an unexpected event.

4. Lost or Delayed Baggage

Another common issue that travelers face is the loss or delay of luggage. While airlines do offer some compensation for lost bags, it may not cover the full cost of replacement items, especially for more expensive items like electronics, clothing, and toiletries. Travel insurance provides coverage for lost, stolen, or delayed baggage, ensuring that you are reimbursed for necessary purchases if your luggage is delayed or lost entirely.

5. 24/7 Assistance and Support

In addition to providing financial coverage, travel insurance often comes with 24/7 assistance services. These services can be invaluable if you find yourself in a foreign country, struggling to navigate the healthcare system, or need help locating a doctor or medical facility. Many travel insurance providers offer multilingual support and emergency help lines, making it easier for Canadians to get the assistance they need no matter where they are.

In Sarah’s case, her travel insurance provider connected her with a local hospital and assisted with the necessary paperwork and medical arrangements, reducing the stress and confusion of navigating an unfamiliar healthcare system.

6. Peace of Mind

Ultimately, one of the greatest benefits of purchasing travel insurance is the peace of mind it provides. Knowing that you are protected from financial risk and have access to assistance in the event of an emergency allows you to focus on enjoying your vacation. Travel insurance ensures that you can take a trip with confidence, knowing that you're covered for a wide range of potential issues.

Conclusion

While no one plans for unexpected events, travel insurance can be a lifesaver for Canadians traveling abroad. Whether you're facing a medical emergency like Sarah’s experience in Mexico, needing to cancel a trip due to unforeseen circumstances, or dealing with lost luggage, having travel insurance in place can provide invaluable protection and peace of mind. By investing in travel insurance before you embark on your next international adventure, you can ensure that you are prepared for the unexpected, allowing you to focus on creating unforgettable memories without the worry of what might go wrong.

#insurance #katsen #katseninsurance #alexandrakatsen #agent #insuranceagent #katsenalexandra

How Easy Access to Accident Coverage Can Bring Peace of Mind to Your Everyday Life

In today's fast-paced world, accidents can happen at any time, and having the right protection in place can make all the difference. Whether it's a small slip on a rainy day, a sudden mishap at work, or an unexpected fall during outdoor activities, life is unpredictable. But what if there was a simple way to ensure you’re covered, no matter what happens?

Imagine a product that takes the stress out of dealing with the unknowns of daily life, offering a quick and easy way to access comprehensive coverage when accidents strike. This type of coverage is designed to protect everyday people like you and me, from all walks of life, ensuring that a sudden incident doesn't throw off your entire life.

One of the most remarkable features of this coverage is its accessibility. Getting the protection you need is straightforward. You don’t need to spend hours navigating complicated insurance jargon or filling out endless paperwork. With just a few simple steps, you can secure the coverage and rest easy knowing you're protected from unexpected expenses.

In terms of effectiveness, this coverage works by stepping in when you need it most. Whether it's medical expenses from an unexpected injury or other costs associated with an accident, the coverage helps reduce the financial burden that can come from such events. It’s designed to support you through recovery, ensuring you don't face an additional layer of stress in an already difficult time.

The real power of this product lies in its ability to integrate seamlessly into your life. Whether you’re at work, out with friends, or enjoying a weekend getaway, knowing that you're covered if an accident occurs can be a huge relief. It’s a safety net that doesn’t interfere with your daily routine, but is always there when you need it most. This makes it ideal for people who lead busy, active lives and want the peace of mind that comes from knowing their bases are covered without any extra hassle.

Furthermore, the product is designed with flexibility in mind, so it can fit a wide variety of needs. Whether you're a busy professional, a parent with children, or someone who enjoys outdoor activities, this coverage adjusts to your lifestyle. It makes managing the unforeseen a lot less daunting.

In a world where accidents are a part of everyday life, it’s essential to have a reliable solution that offers not just peace of mind, but practical financial support. This coverage does just that, delivering both simplicity and effectiveness for individuals from all walks of life, ensuring that no matter what happens, you’ll be able to move forward without unnecessary stress or delay.

#insurance #katsen #katseninsurance #alexandrakatsen #agent #insuranceagent #katsenalexandra

Important facts about Visitors to Canada insurance

Let’s start the week from learning important facts about Visitors to Canada insurance(most rules apply for Super visa as well):

1. Visitors to Canada insurance have two types of coverages: with and without pre-existing conditions. You must choose the package based on the visitor’s health

2. There is a waiting period if you buy the insurance policy after the visitor arrives to Canada. It is important to but the insurance prior to departure.

3. There is a stability period that needs to be met when you purchase the coverage with pre existing conditions. So the existing health conditions will be covered.

4. You do not have to give details like names of medications or detailed recovery plan of the visitor to the agent, since we are not allowed to go through details like that anyway. However, we still need to be informed about the existing conditions and how stable they are to provide the best advice possible.

5. Remember to go over the exclusion part of the policy. It is very important.

6. If your visitor goes back home early, you’re eligible for a particular refund if no claims were submitted.

7. In a time of an emergency you must call the insurance company within 24 hours

8. Some policies cover the flights to and from Canada (some conditions apply)

9.You can make a few claims during one trip, and the company will pay out all of them up to the sum insured

10. The policy does not cover routine care and does not include maintenance medications or vaccinations.

Have questions or want to lean more? Contact me at [email protected] or call 204-807-1805

#insurance #katsen #katseninsurance #alexandrakatsen #agent #insuranceagent #katsenalexandra

Why you should choose to work with an insurance agent and not buy the insurance myself?

Working with an insurance agent can offer several advantages over buying insurance on your own:

Working with an insurance agent can offer several advantages over buying insurance on your own:

Expertise and Guidance: Insurance agents are knowledgeable professionals who can help you navigate the complexities of insurance policies. They can assess your needs, recommend appropriate coverage options, and explain any terms or conditions you may not understand.

Customized Solutions: An agent can tailor insurance policies to fit your specific requirements. They can help you identify risks and select coverage that adequately protects you, your assets, and your loved ones.

Access to Multiple Carriers: Agents typically work with multiple insurance companies, giving you access to a variety of coverage options and pricing. They can shop around on your behalf to find the best combination of coverage and value.

Personalized Service: Agents provide personalized service and ongoing support. They can assist you with policy changes, claims processing, and any questions or concerns you may have throughout the life of your policy.

Claims Assistance: In the unfortunate event that you need to file a claim, your agent can guide you through the process, advocate on your behalf, and ensure a smooth resolution.

Convenience: By working with an agent, you can save time and effort compared to researching and purchasing insurance on your own. Your agent can handle all the paperwork and administrative tasks, freeing you up to focus on other priorities.

While buying insurance yourself is an option, working with an agent can provide valuable expertise, guidance, and support to help you make informed decisions and protect what matters most to you.

If you would like to schedule you consultation, please call 204-807-1705

#insurance #katsen #katseninsurance #alexandrakatsen #agent #insuranceagent #katsenalexandra

BLACK FRIDAY DEAL????IT'S ALWAYS HERE!

With an extended coverage, you can get the additional benefits of:

This product is available for individuals aged 15 days to 70 years old.

New!

Make sure you check it out! | The Link Between

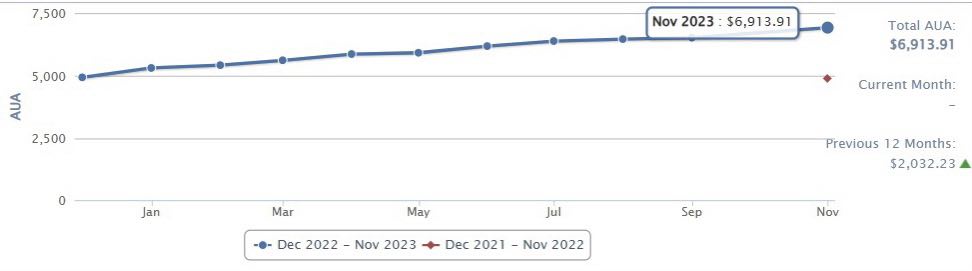

The best gift for your child.....RESP?

Do you think it is a good gain for one year?

Let me know if you have questions about investments or insurance 204-807-1705 / [email protected]

#insurance #katsen #katseninsurance #alexandrakatsen #agent #insuranceagent #katsenalexandra