Avoiding Costly Mistakes in Health Insurance: A Guide to Protecting Yourself and Your Loved Ones

Avoiding Costly Mistakes in Health Insurance: A Guide to Protecting Yourself and Your Loved Ones

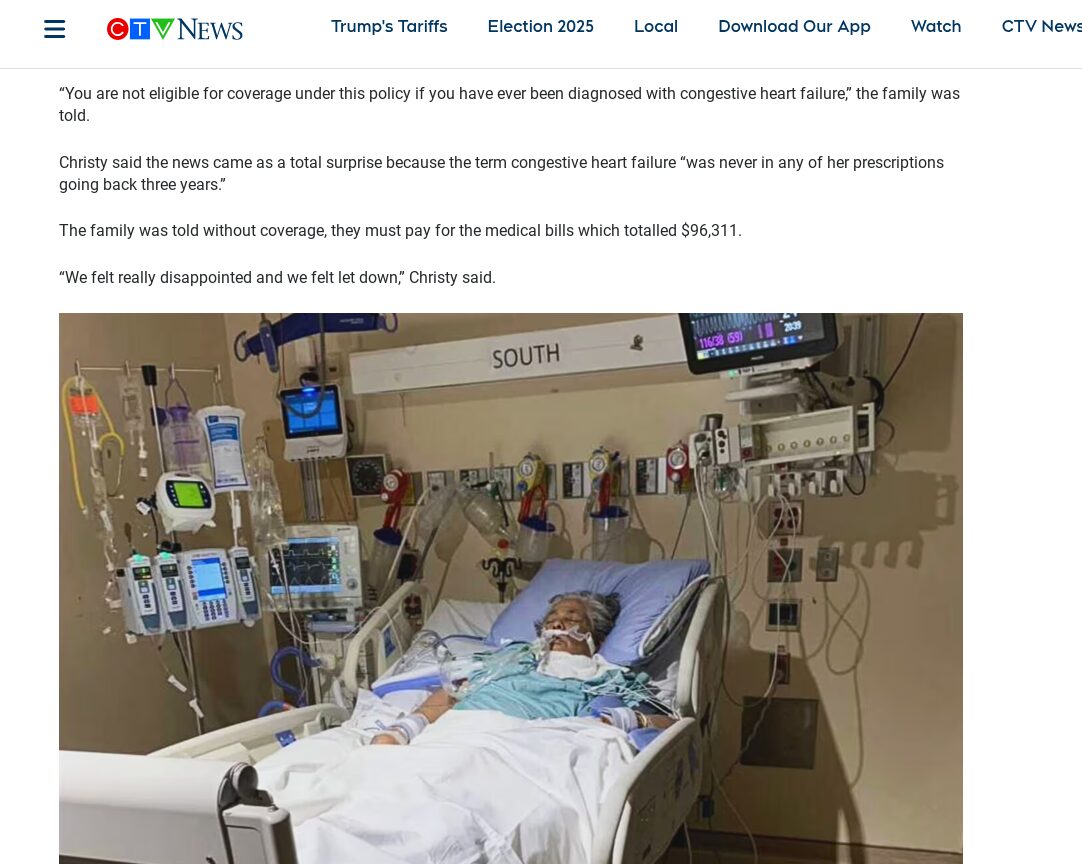

As an insurance professional, I’ve seen firsthand the importance of making informed decisions about your health coverage, and I want to address a situation that’s recently been highlighted in the news. A family from Ontario was hit with a staggering hospital bill of $96,311 after visiting a hospitalised relative in India (the article can be found here:

https://www.ctvnews.ca/toronto/consumer-alert/article/ontario-family-hit-with-96311-hospital-bill-after-visiting-mother-from-india-hospitalized/.

While international medical expenses can be overwhelming, there are critical lessons to be learned here about protecting yourself and your family.

I believe the key to avoiding such financial pitfalls lies in understanding your insurance coverage thoroughly. Here are some tips to ensure that you are properly covered and prepared, especially when traveling abroad or dealing with unexpected medical situations:

1. Never Hide Medical Conditions

When applying for health insurance, full disclosure is essential. If you have any pre-existing conditions or chronic health issues, it’s crucial that you inform your insurance provider. Attempting to hide medical conditions or provide incomplete information might seem like a way to lower premiums, but it can lead to devastating consequences when you need your coverage the most.

In the case of the Ontario family, their situation was complicated by a lack of clarity regarding their coverage and medical history. If they had fully disclosed their medical conditions to their insurer, it’s possible that they would have been able to better navigate the healthcare system in India without facing such astronomical costs.

Insurance companies rely on the information you provide to determine your eligibility for specific coverage. Withholding medical details can invalidate your policy or result in higher out-of-pocket costs when it’s time to claim.

2. Read Your Policy Carefully

It’s easy to skim through the fine print of an insurance policy and assume everything is covered, but that’s a mistake many people make. Take the time to thoroughly read and understand the terms and conditions of your policy. This includes the details on coverage limits, exclusions, and specific provisions for international healthcare.

In the story of the Ontario family, the policy they purchased didn't cover the full cost of treatment abroad, leaving them to cover a large portion of the bill. By fully reviewing their coverage before they traveled, they may have been able to select a more comprehensive plan that would have better supported them in this unexpected situation.

Remember, insurance policies can vary widely, and not all plans offer the same level of international coverage. Whether you’re traveling for business, leisure, or to visit family, it’s vital to know exactly what is included in your policy.

3. Don’t Choose the Cheapest Option

While it may be tempting to choose the cheapest insurance option to save money upfront, this can lead to serious financial headaches down the road. Many low-cost policies offer limited coverage or exclude certain critical areas, especially when it comes to emergency medical care or international health services.

In the case of the Ontario family, opting for a less comprehensive insurance plan may have been a contributing factor to the large bill they faced. When it comes to health insurance, you get what you pay for. Choosing a plan based on price alone without considering the scope of coverage can leave you vulnerable to unexpected expenses.

Instead, work with an advisor to find a policy that balances cost and coverage. A good policy should provide the right level of protection based on your individual needs and the specifics of your travel or healthcare situation.

4. Work with a Knowledgeable Advisor

Navigating the complexities of health insurance, especially when considering international travel or emergency care, can be overwhelming. That’s where a knowledgeable insurance advisor comes in. An experienced professional can help you understand the fine print of your policy, advise you on the best options for your circumstances, and ensure that you’re properly covered for any potential risks.

In cases like the Ontario family’s, having an expert to guide them through the insurance process might have prevented misunderstandings or gaps in coverage. A good advisor can explain your options clearly, help you choose the right level of coverage, and answer any questions you may have, ensuring that you’re not left in a tough situation when you need help the most.

To conclude,Health insurance is a vital safeguard that can provide peace of mind during both routine and emergency situations. However, to ensure it works for you, it’s essential to be transparent about your health, read your policy carefully, and choose the right coverage to suit your needs. Don’t be tempted by the cheapest options – they may end up costing you more in the long run.

Most importantly, work with a knowledgeable insurance advisor who can guide you through the complexities of insurance and help you make informed decisions. With the right preparation and the right advice, you can avoid costly surprises like the Ontario family’s and make sure you’re protected when it matters most.

If you have any questions about your current policy or need advice on finding the right health insurance coverage, feel free to reach out. I'm here to help!